Washington Grant + Oak is switching out hand soap for wet wipes — specifically the wing eating variety. We’re talking about Buffalo Wild Wings! The team has decided to take on a new client, which means recapping all of what we did for Dial but for BW3s.

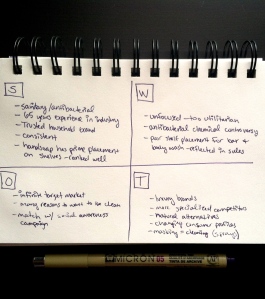

SWOT Analysis:

Strengths:

Family-Friendly

Ubiquitous with sports bars identity/well-known/popular

Community Involvement (sponsorship)

Has an established culture (Blazin’ Challege Wall of Fame)

Varied menu besides wings

Tons of televisions, also occasionally prize-based arcade games

Weaknesses:

Slower during off seasons

Reputation with service isn’t strong

Menu variety isn’t known

More masculine appeal, deterring women & children

Crowded competition

(People stop going out because of recession/make their own wings/food?)

Opportunities

International expansion

Cater to other kinds of sports

Optimize square-foot efficiency (Similar to Chipotle)

Threats

People eating at home

Places with a fuller menu (more variety, not all chicken)

Competitors:

Applebees

Chilis

TGI Fridays

Hooters

Ruby Tuesdays

Red Robins

Max & Ermas

BJs

Quaker Steak & Lube

Champs

Dave & Busters

Wing Street

Segmentation:

Die hard Sports Fans

Male

Own sports memorabilia

Values ESPN, sports section

Probably enjoys beer, salty snacks, nothing incredibly healthy

Probably more extroverted (at least with other sports fans)

Their schedules work around their games

This category can split into two social groups

Group 1:

Uses BW3s as an alternative to going to actual games

Lower-Middle class

-More willing to compromise/rather be in a comfortable and convenient space

Group 2:

Uses BW3s as a post-game get-together

Middle-Upper class

Bros

Male

Relationship with male friends is very strong

Value time spent with friends

Often engage in social settings, events, parties, etc.

Typically prefer camping, videos games, movies, parties, etc. over sporting events

Probably enjoy beer, but value connection with others

Don’t cook for themselves much (eat out often), but when they do, it’s microwaved nachos, mac & cheese, grilled cheese, cereal, etc.

Often opt for cheaper food, but know when to treat themselves

Usually nocturnal

Extroverted

Families

Male/Female

Go out to eat for special occasions/get-togethers

Extracurricular Groups/Clubs

Business meetings

Retreats

Team building

Enjoy being around people

Extroverted

Involved

Strong interests

Data for a comparison chart

Compare above threats with BW3s and the following factors:

Entertainment

Bar

Family-Friendly

Wings (serves wings, how big is it?)

Public Perception (via Yelp! or Facebook)

Project/Brand Challenges

1. Acquiring an audience that may not be primarily invested in “Wings, Beer, [and] Sports”

Research Objectives:

• Research restaurants that successfully showcase a variety of menu items

• Investigate how BW3’s menu is laid out, and how/what people people look through when visiting

• Investigate menus at comparable restaurants

• Learn about parents’ thinking process as it pertains to choosing places to take their kids

2. Improve the reputation of BW3’s service

Research Objectives:

• Research which places receive far better service, and why that could be

• Determine what parts of the experience customers value the most

3. Find ways to increase patrons during the day hours

Research Objectives:

• Determine where people are going during the day, and why they might choose that over BW3’s

• Figure out what time of year is most likely

Line of Questioning:

Sports Fans:

Do you value the size of the television over the value of the food?

What’s the culture at BW3s?

Do you eat with your hands?

Are you sensitive to noise?

How often do you wash dishes?

What’s your favorite sport?

Are you a morning or night person?

Do you participate in sports?

When do you get off of work?

How often do you go out with friends?

Do you follow any teams or athletes closely?

Do you subscribe to any sports magazines?

What are your favorite TV channels?

What’s the complexity of your TV subscription?

How many TVs do you own?

How often do you check the time?

Are you on any kind of food regimen or diet?

What is the first section of the newspaper you look out?

What’s your favorite beer? What time do you eat dinner?

Do you open a tab when you go out?

Families:

Do you go to places that offer children’s meals free?

How closely do you monitor your child’s diet?

How often do you use silverware?

Do you order appetizers?

How long does it take you to prepare dinner for your family?

How often do you go out to eat?

Bros:

Are you single?

How much money per week do you spend on food?

Do you go grocery shopping? How often?

What time is your last meal of the day?

How often do you get food delivered?

How often do you hang out with your friends?

How often do you watch sports on TV? How long?

What is your favorite TV channel?

How many meals do you eat a day?

Extracurriculars:

What kind of clubs are you involved in?

How often do you meet?

How many hours a week do you see these people?

Do you go to the same place every time?

Who sponsors your club, if any?

Who pays for the food?

How do you make friends?

Do you split appetizers?

What kinds of things do you find worth celebrating?

We think it would take a couple of weeks to gather all of the information and actually sit down with potential targets. An hour of questioning between each group would be the most likely scenario.